European steel market seeks direction

The European holiday season is in full swing, exacerbating already weak steel demand. Purchasing has been put on hold this month. Distributors and service centres are waiting for September, to evaluate the price direction.

Producers attempted to raise prices, for both flat and long products, before the summer shutdowns. This occurred mostly during price discussions, but some mills issued formal price increase letters to customers. Buyers dismissed these proposals as unworkable.

Few distributors felt compelled to place stock purchases in advance of the holidays. Commodity items are readily available, and decisions could be deferred.

Mills are undertaking planned annual maintenance, this month. Faced with a lack of orders and the inevitable negative pressure on prices, they are extending shutdowns, up to six weeks.

Steel processors remaining open during the holiday season face the twin problems of reduced order books and staff absences. Many have cut operational shifts. They are considering the future introduction of two-week summer closures, in line with steel manufacturers.

The EU and UK quotas for hot rolled coil from “other countries” were fully subscribed early in the current period. Market participants expect that the same category will be heavily oversubscribed on October 1, resulting in congestion at European ports.

Buyers are, therefore, averse to placing new import orders, for arrival later in the fourth quarter, as these would automatically attract the full 25 percent tariff. European mills consider that this reluctance will increase domestic demand and provide the opportunity to raise prices. The arrival of more than one million tonnes of imported hot rolled coil, however, could saturate a weak market and have the opposite effect.

The political situation also affects market sentiment. In Spain, the recent snap general election proved inconclusive. Constitutional talks are starting but no party has a clear majority. Consequently, investment decisions are on hold.

In Germany, meanwhile, confidence in the state’s ability to act is at a new low. According to a recent survey, 69 percent of citizens consider that the state is unable to fulfil its tasks. Infrastructure, investments in climate protection and the expansion of renewable energies are cited as key areas where leadership is lacking. Medium-sized German steel-using companies also bemoan the lack of government support.

A recent recovery in Chinese steel demand appeared to offer positive signals for the international market. This, however, was short-lived, amid weak construction indicators. Chinese real estate companies are in financial difficulties, reducing demand for structural grade products.

In Europe, purchasing activity is likely to remain at a low level for this month. Mills will seek to raise prices, at the earliest opportunity. Buyers will watch for clear signs of the next direction, before committing to new stock orders.

Steel News

EU coil price outlook deteriorates

Despite the expectation that the low point in the current cycle had been reached, prices for steel coil continued to decline in mid/late July, albeit modestly.

The mills’ attempts to raise their selling values failed, and discounts were offered to fill order books.

Most producers, particularly those in southern Europe, are currently not offering, due to scheduled maintenance outages. They are likely to resume quoting in late August or early September.

Target figures of €680/700 per tonne for hot rolled coil and €780/800 per tonne for cold rolled coil are expected, for October deliveries.

However, many buyers doubt that demand will be sufficient to support any rises. Those that do forecast increases believe that they will be modest and short-lived.

In the distribution sector, conditions in Germany and Spain are reported to be particularly weak, with activity in France faring slightly better in comparison.

Resale prices have mainly stabilised, but downward pressure persists amid continuing strong competition.

Although some sellers state that their stock levels are high, most comment that their inventories are normal-to-low.

Seasonal stock replenishment is predicted in the autumn. However, it may be limited by weak end-user demand and buyers’ cautious sentiment.

The outlook for steel consumption in the rest of this year is weak.

Conditions in the construction, white goods, packaging and mechanical engineering industries are being adversely affected by rising interest rates, high inflation and weak investor sentiment.

The German economy – which provides a major source of industrial activity across Europe – is close to recession.

One of few positives for steel coil demand is the automotive sector.

Vehicle output is recovering, following previous supply chain problems related to the Covid pandemic and the Ukraine-Russia war.

Most auto-related service centres maintain an optimistic outlook for sales volumes in September, following the restart of carmaking plants after maintenance shutdowns in August.

Steel and steel raw materials

The steel industry underpins the global economy. It is deeply intertwined with other industries like automotive, construction and energy – making it subject to risks and opportunities from multiple directions. Decarbonization initiatives also have significant implications for anyone buying, selling or trading in steel markets. These risks include shifts in international competitiveness and the financial risk associated with carbon pricing and regulations. On 8 June, Fastmarkets launched a suite of green steel prices to bring clarity and support investment decisions needed to reduce emissions.

You can understand the critical forces impacting steel news and steel price movements with our reliable data-driven insights, market-reflective prices, forecasts and analysis.

Navigate the complexities of the steel industry and make informed decisions with our global coverage of steel market news, steel price developments, steel market trends, forecasts and analysis.

Our steel and steel raw materials market experts provide global and local data-driven insights combining the commodity intelligence of familiar names like Metal Bulletin, American Metal Market, Scrap Price Bulletin, Industrial Minerals and more.

Bahrain Steel inks pact with Essar Group's KSA Green to supply iron ore pellet to GSA project

Bahrain-based firm Foulath arm Bahrain Steel has collaborated with Essar Group's KSA Green Steel Project for supply of iron ore pellet to Green Steel Arabia (GSA) project. Through this partnership, the Bahrain Steel will deliver four million tonnes of DR-grade pellets per annum (mtpa) to Essar Group, a statement said.

The Bahrain Steel is the only (Gulf Cooperation Council) GCC-owned pellet producer and leading supplier of high-quality DR grade pellets to all integrated steel producers ..

July 2023 crude steel production

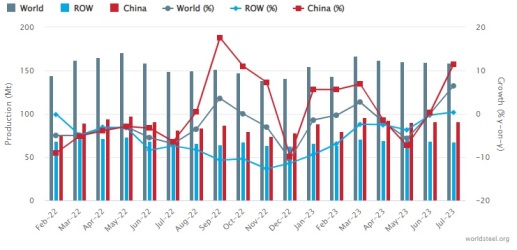

World crude steel production for the 63 countries reporting to the World Steel Association (worldsteel) was 158.5 million tonnes (Mt) in July 2023, a 6.6% increase compared to July 2022.

Crude steel production

Crude steel production by region

Africa produced 1.4 Mt in July 2023, up 26.1% on July 2022. Asia and Oceania produced 119.9 Mt, up 9.1%. The EU (27) produced 10.3 Mt, down 7.1%. Europe, Other produced 3.6 Mt, up 5.1%. The Middle East produced 3.1 Mt, down 3.9%. North America produced 9.4 Mt, down 1.2%. Russia & other CIS + Ukraine produced 7.4 Mt, up 9.3%. South America produced 3.4 Mt, down 8.4%.